11th October 2024

Key points

- New Zealand rate cuts accelerate

- Aussie consumer confidence rises

- U.S. inflation falls

- Fiscal spending – a ticking time bomb

Global Cash Rates & Inflation

● The Reserve Bank of Australia (RBA) Cash Rate now sits at 4.35%pa and the annual inflation rate in the year to August is 2.7%.

● The US cash rate (policy rate) is currently between 4.75%-5.0%pa and the annual inflation rate in the year to September is 2.4%.

● The Bank of England Bank Rate currently sits at 5.0%pa to fight an inflation rate of 2.2% in the year to August

● The European Central Bank Cash Rate (deposit facility) is 3.5%pa, to fight an annual inflation rate of 1.8% in the year to September.

The Reserve Bank of New Zealand has slashed its key policy rate by 50 basis points as recessionary fears intensify.

Economic conditions in New Zealand have deteriorated due to persistent weakness in consumer spending and rising unemployment, and the central bank is expected to cut by another 50 basis points next month.

While inflationary pressures have been more persistent in Australia, recent data on wage growth and household spending suggests the Reserve Bank of Australia may need to consider rate cuts sooner than later to support growth.

However, it’s important to note that the Reserve Bank of New Zealand raised rates much more aggressively than the Reserve Bank of Australia, so they are likely to cut rates more swiftly as well.

Aussie Consumer Confidence Rises

The latest consumer confidence data released by Westpac reveals that optimism is increasing as the fear of further rate hikes dissipates.

Despite remaining in negative territory, the Consumer Sentiment Index increased by 6.2% to 89.8, a two and half year high, potentially indicating that pessimism may have bottomed.

The Reserve Bank of Australia will likely be watching these figures with a degree of trepidation, as increasing consumer optimism could reignite inflationary pressure.

U.S. Inflation Falls

Inflation in the U.S. eased further in September to 2.4%, providing further indication that the world’s largest economy continues to cool.

The Federal Reserve lowered its key policy rate by 50 basis points at its latest meeting, but uncertainty remains over whether additional cuts will follow in November.

Regardless of the exact timing, the trend for interest rates in most developed countries appears to be downward, highlighting the shrinking window to lock in higher rates now.

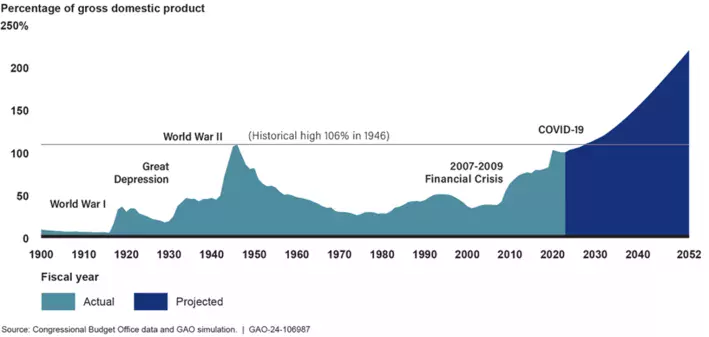

However, as reported in the Australian Financial Review, both JP Morgan’s Jamie Dimon and Bridgewater Associate’s Ray Dalio believe that upside risks to inflation remain, especially due to growing budget deficits which are inflationary by nature.

This is something which Australian Bond Exchange co-founder Markus Mueller has also repeatedly warned about and reiterates the importance of maintaining a diversified fixed-income portfolio with fixed, floating, and inflation-linked securities.

Week Ahead

- European Central Bank rate decision

- U.S. retail spending

- Japanese inflation data

- UK inflation and employment data

*Data accurate as at 10.10.2024

Disclaimer: This document has been prepared by ABE Distribution Pty. Ltd ACN 673 177 912 Corporate Authorised Representative 1307088 (“ABE”) and is of a general nature only. It was prepared without considering your financial needs, circumstances and objectives. Before investing in a fixed-interest product with ABE, you should consider whether it is appropriate for your circumstances and review the relevant terms and conditions. This document contains links to other third-party websites, some of which require a subscription to read. Such links are for your convenience only, and ABE does not recommend or endorse these third-party sites.. No representation or warranty is made as to the accuracy, completeness or reliability of any estimates, opinions, conclusions, or other information contained in the content. The content may contain certain forward-looking statements. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties, and other factors, many of which are beyond our control. To the maximum extent permitted by law ABE disclaims all liability and responsibility for any direct or indirect loss or damage that you may suffer as a result of relying on anything in this content. Past performance is not an indication of future performance